Some Known Facts About Property Damage.

Table of ContentsPublic Adjuster Fundamentals ExplainedIndicators on Public Adjuster You Should Know8 Simple Techniques For Public Adjuster

A public adjuster is an independent insurance professional that an insurance policy holder might work with to help settle an insurance policy claim on his or her behalf. Your insurance provider gives an insurance adjuster at no cost to you, while a public adjuster has no relationship with your insurance provider, and charges a charge of as much as 15 percent of the insurance coverage negotiation for his/her services.

If you're thinking about employing a public insurance adjuster: of any type of public insurance adjuster. Ask for recommendations from family as well as partners - loss adjuster. Ensure the insurance adjuster is licensed in the state where your loss has happened, and also call the Better Organization Bureau and/or your state insurance coverage division to check out his or her document.

Your state's insurance policy department may establish the percent that public adjusters are allowed charge. Watch out for public adjusters that go from door-to-door after a catastrophe. property damage.

Financial savings Contrast rates and also save on house insurance policy today! When you file an insurance claim, your property owners insurance business will certainly designate an insurance claims insurer to you.

The Facts About Property Damage Uncovered

Like an insurance claims insurance adjuster, a public insurer will certainly assess the damages to your property, aid establish the scope of repairs and also approximate the replacement value for those repair services. The large difference is that as opposed to dealing with part of the insurance provider like an insurance coverage asserts insurance adjuster does, a public claims adjuster benefits you.

The NAPIA Directory notes every public adjusting firm needed to be licensed in their state of operation (public adjuster). You can enter your city and state or postal code to see a listing of adjusters in your location. The various other way to discover a public insurance policy adjuster is to get a referral from friends or household members.

Many public insurance adjusters maintain a percent of the final case payment. If you are look at this web-site facing a big case with a possibly high payout, variable in the rate prior to picking to hire a public insurance adjuster.

Getting My Property Damage To Work

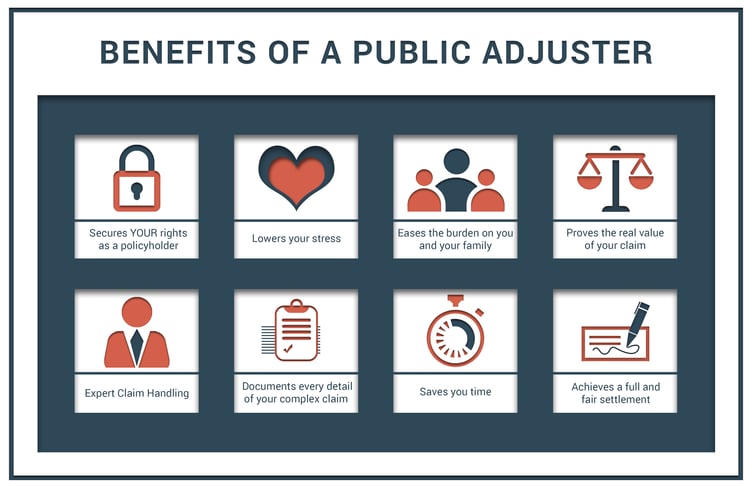

To confirm to this dedication, public adjusters are not compensated front. news Instead, they obtain a portion of the negotiation that they obtain in your place, as managed by your state's department of insurance coverage. A skilled public insurer works to achieve several jobs: Understand as well as assess your insurance plan Promote your rights throughout your insurance policy case Accurately and extensively analyze and value the range of the residential property damage Apply all policy stipulations Bargain a made the most of negotiation in an efficient and effective way Dealing with a knowledgeable public insurance adjuster is one of the finest methods to get a fast and fair settlement on your insurance claim.

As a result, your insurance provider's agents are not necessarily going to search to discover all of your losses, viewing as it isn't their responsibility or in their best passion. Considered that your insurance policy company has a professional working to shield its rate of interests, shouldn't you do site web the very same? A public insurer can work with lots of various sorts of claims in your place: We're commonly asked regarding when it makes sense to hire a public cases insurance adjuster.

Nevertheless, the bigger and more complicated the case, the most likely it is that you'll need specialist help. Employing a public insurer can be the best selection for many different kinds of building insurance coverage claims, specifically when the stakes are high. Public adjusters can aid with a variety of valuable tasks when navigating your insurance claim: Translating plan language and also determining what is covered by your company Performing an extensive evaluation of your insurance coverage Taking into account any type of recent adjustments in building ordinance and laws that might supersede the language of your policy Completing a forensic analysis of the building damages, often uncovering damages that can be otherwise difficult to find Crafting a personalized plan for getting the very best settlement from your property insurance case Recording and also valuing the complete extent of your loss Compiling photographic proof to sustain your insurance claim Managing the everyday tasks that usually come with suing, such as communicating with the insurance provider, participating in onsite meetings and submitting documents Offering your insurance claims bundle, including sustaining paperwork, to the insurance provider Masterfully discussing with your insurance coverage firm to guarantee the biggest settlement feasible The very best part is, a public claims insurer can obtain included at any kind of point in the claim declaring procedure, from the minute a loss strikes after an insurance coverage case has actually currently been paid or rejected.